Check out the Strength of Prop Firm Passing Service

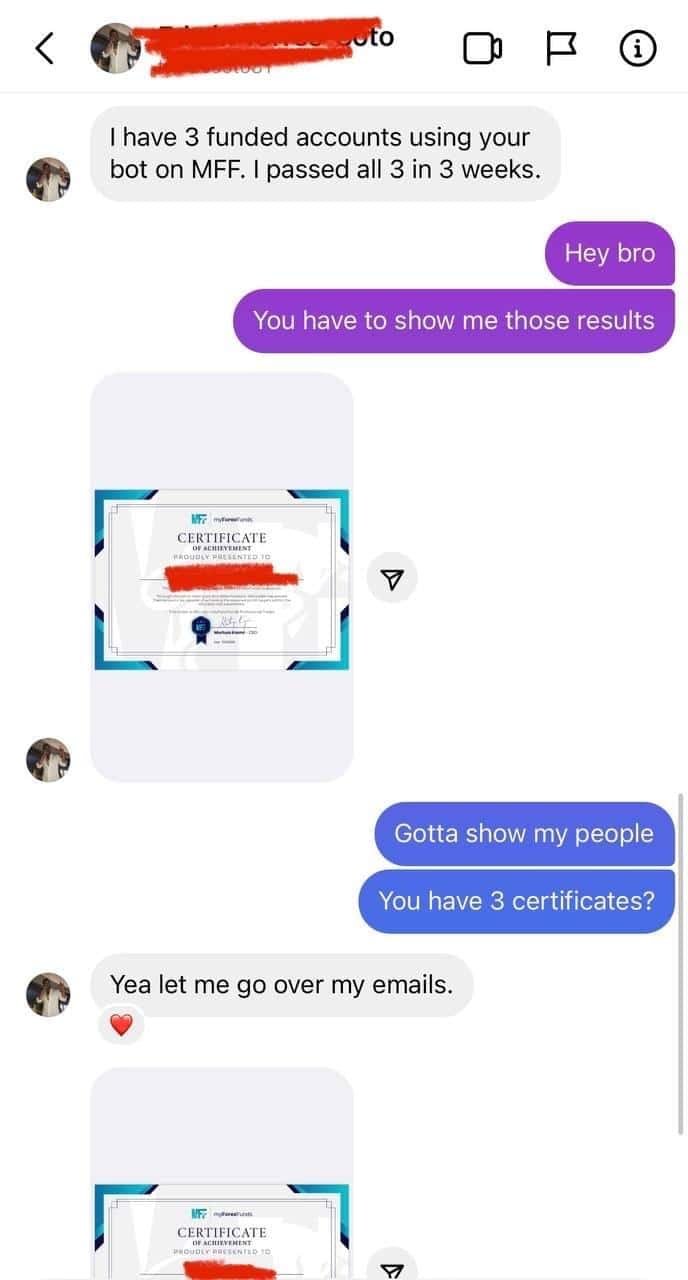

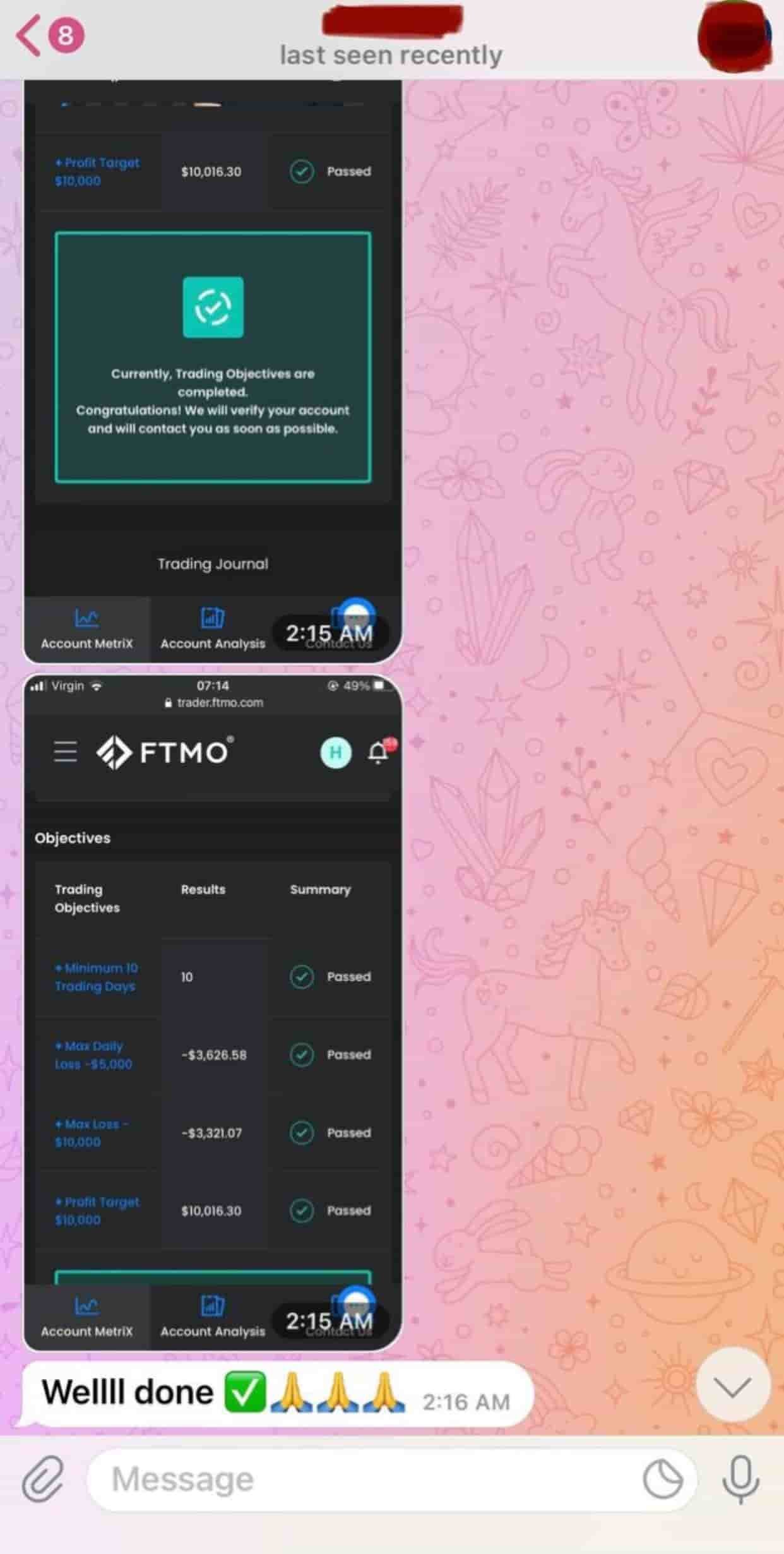

Explore the power of our service through Certificates of Achievement, Client Reviews, and tangible Results & Progress.

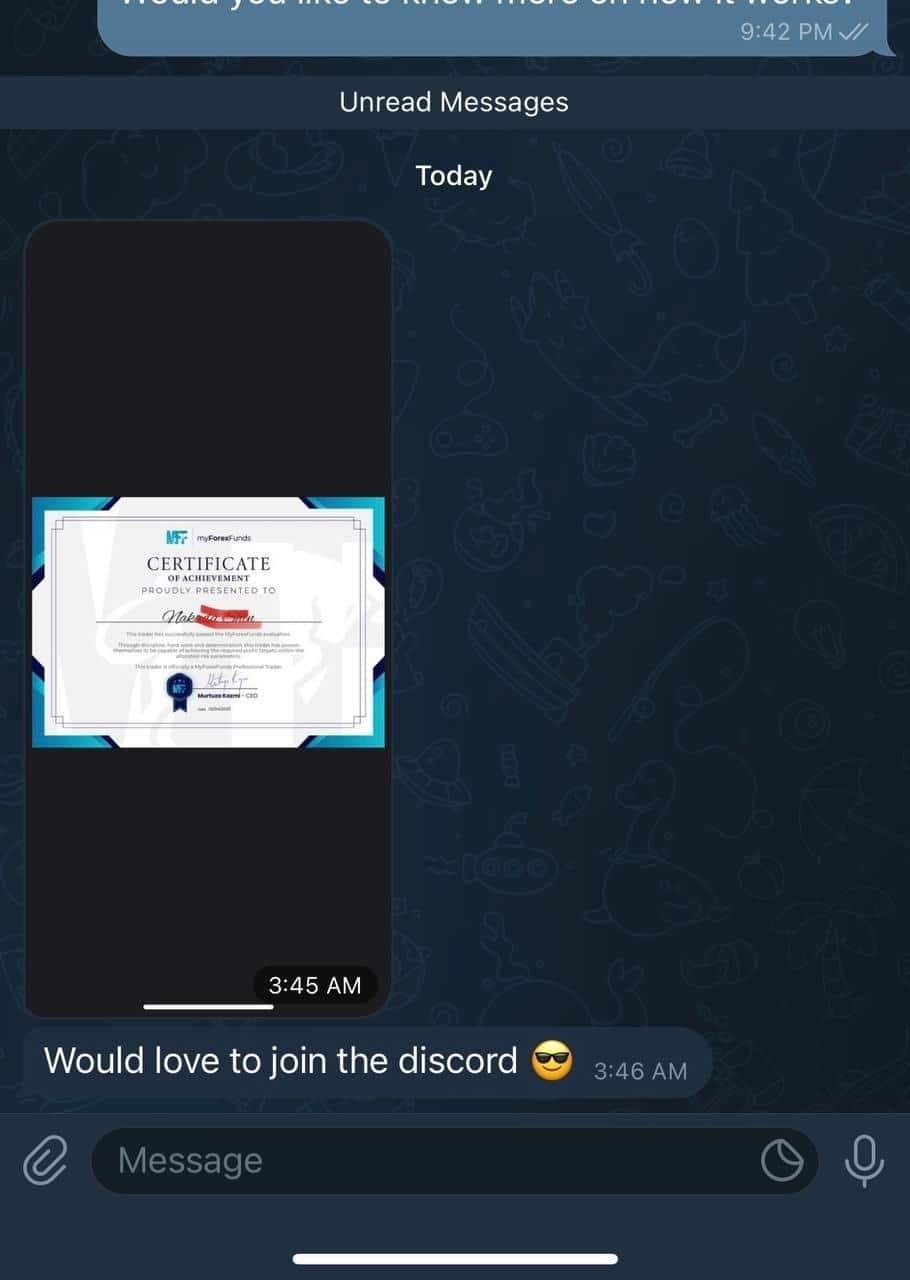

Certificates of Approval

Frequently Asked Questions

Absolutely, we offer services aimed at recovering losses or drawdowns in trading accounts. Our team of skilled traders will assess your account’s condition and devise a tailored strategy to help you recuperate your losses and steer your account toward recovery.

Understanding that losses are an inevitable part of trading, and even the most successful traders can face downturns, our recovery services are designed to help clients bounce back from setbacks and restore their confidence in trading.

Upon successfully transitioning to the funded account management stage after the review, we manage all trading activities for you. As the payout date nears, you’ll be notified by the prop firm, such as FTMO, about your ready withdrawal through an email. An invoice detailing our profit share will be sent to you. We aim for at least a 10% monthly return, with our record being a 45% return.

For a $100,000 account, the initial profit share includes 20% for FTMO (reducing to 10% on subsequent withdrawals), 30% for our management services, and 50% for you. Your share increases to 60% from the second withdrawal onwards.

Our recommendations lean towards firms that have proven to be dependable and have earned a good reputation in the industry. Firms such as MFF, FTMO, TFT, TFF, E8, among others, stand out as our preferred choices. The vast majority of our clients have successfully received their payouts from these firms without any issues.

The number of accounts a client can pass is determined by the maximum allowed by each proprietary trading firm. Our service supports clients in managing multiple accounts, provided they have the financial means to do so.

Our team of skilled and successful traders is capable of handling several accounts concurrently, making sure they adhere to the prop firm’s criteria for profit targets and risk management. We focus on delivering both efficient and high-quality services, aiming to assist our clients in achieving their trading goals.

Can I execute my own trades during the period you manage my challenge or trade on my funded account?

Engaging in your own trading activities while we manage your challenge or operate your funded account is strictly prohibited and violates our terms and conditions. It is important to note that you are not required to take any action during this period.

After we have processed your account credentials and received the payment for the service fee, we will promptly initiate the setup of your timeline for initiating trading after my account credentials are submittedur account. Trading activities will commence in the following session once the enrollment is complete.

Please note that independent trading is a violation of our terms and conditions.

Additionally, our trading activities are confined to the London and New York trading sessions, during times that offer a higher probability of success, in order to minimize potential losses.

Our baseline objective for funded accounts is a 10% Return on Investment (ROI), but we don’t stop there. When the market conditions are favorable, we seize the opportunity to target higher profits. Our track record includes reaching a peak ROI of 45%, showcasing our ability to capitalize on the right market opportunities for substantial gains.

Our team is dedicated to risk management and upholding a disciplined trading approach, significantly minimizing the risk of breaching trading rules. However, should an unexpected setback occur, our Refund Policy is in place to ensure a swift refund process.

Moreover, we offer Free Repeats under specific conditions, such as when the Trading Period is nearing its end, the account maintains a positive balance albeit submitted late, or there’s a considerable drawdown. Our initial focus is to recover the account to a positive standing before aiming for the profit target.

Our risk management strategy is conservative, ensuring that no more than 1% of the account balance is risked on a single trade. We target a minimum reward-to-risk ratio of 1:3, indicating that for a potential risk of $500, we aim to make a return of at least $1500.

We adhere to a manual trading approach, relying on our seasoned traders to scrutinize the market and make informed decisions. Through thorough market analysis, our specialists identify promising opportunities and execute trades manually. We refrain from utilizing Expert Advisors (EAs), as their use is often restricted by many brokerage firms.

We accept a variety of payment methods, including Debit Card, Skrill, USDT (TRC20), and Bitcoin (BTC), to accommodate your preferences for our services.

Maintaining the confidentiality and security of our clients’ information is paramount when trading with a prop firm. We implement all necessary measures to ensure your privacy is protected at every stage.

To prevent the prop firm from detecting that someone else is trading on your behalf, we advise against accessing your MT4/MT5 trading platform until you secure a VPN or VPS service. Alternatively, you can utilize our pre-arranged VPS service.

Our strategy includes the use of highly secure Virtual Private Networks (VPNs) to conceal our IP addresses, making it extremely difficult for prop firms to trace trading activities back to our team. Our traders are well-versed in the evaluation and account management processes, enabling us to operate discreetly and avoid any unnecessary scrutiny.

Our ultimate aim is to assist you in successfully passing the evaluation and managing your funded account without any complications, ensuring your privacy remains intact. Should you have further inquiries or concerns regarding our privacy safeguards, we encourage you to contact us.

The prop firm passing service operates with our team of proficient funded traders who will trade on your behalf, adhering strictly to the trading guidelines set by the prop firm. Here’s a step-by-step breakdown of the process:

- Purchase a challenge account from the prop firm of your choice (we recommend options like FTMO, MyForexFunds, TheFundedTraders, TrueForexFunds, among others).

- Once you have acquired the challenge account, provide us with your login credentials via WhatsApp or Telegram, and settle the fee for our challenge pass service.

- With this setup, our seasoned traders will take over, employing their expertise to ensure you successfully pass the evaluation.

We take great pride in assisting over 3800 traders in securing funding through our services. Our exceptional success rate, surpassing 90%, underscores our expertise in guiding traders through evaluations and managing funded trading accounts effectively. Our track record, with more than 95% of traders achieving funding, is a testament to our commitment to excellence and our dedication to providing top-notch service to every client.

The service fee is required to be paid prior to initiating trades on your account. This fee covers the evaluation process for both Phase 1 and Phase 2. Paying this fee upfront enables us to streamline operations on our trading floor, ensuring efficiency in our trading activities.

Challenge Completion:

The objective is to achieve a profit target of either 10% or 8%, tailored to the specific requirements of the prop firm. Our dedicated team of traders endeavors to fulfill the trading criteria across both stages within a timeframe of 5-20 days, aiming for successful completion.

Management of Funded Accounts:

After navigating through both stages successfully, our specialized team of funded traders will guide you in overseeing your funded account. We set sights on securing a minimum profit each month, aligning with our commitment to your trading success.

Recovery from Losses:

In instances where your account incurs losses, we invite you to consult with our team for recovery strategies. Our approach focuses on restoring your account to a break-even state or achieving a positive balance. With sufficient time, we even see possibilities to surpass the challenge’s requirements.

A Proprietary Trading Firm, or prop firm, is a company that invests its own capital in the financial markets, rather than managing investments for others. Traders at these firms use the company’s resources to make trades and may receive a share of the profits generated from their trading activities.